Lead: Major package and logistics firms including DHL, UPS and FedEx are accelerating the rollout of autonomous robots and AI across distribution centers in early 2026. Companies report faster throughput and measurable efficiency gains — for example, DHL’s robots can unload containers at up to 650 cases per hour — while simultaneously reshaping hiring, facility footprints and operational strategy. Executives say automation addresses chronic labor shortages and location limits, but unions and analysts warn the transition will shift job skills and network structures. The result is a fast-moving industry pivot that blends human labor with scalable robotic fleets.

Key Takeaways

- DHL reports autonomous systems now speed container unloading up to 650 cases per hour and have driven improvements at roughly 95% of its global warehouses.

- DHL scaled projects from about 240 in 2020 to roughly 10,000 projects by 2026, deploying more than 8,000 collaborative robots and adding 30% robotic capacity over a recent holiday season.

- Item-picking robots at one DHL site raised units picked per hour by 30%; autonomous forklifts at the same location improved efficiency by 20%.

- UPS said it automated 57 buildings in Q4 to reach 127 automated buildings total, with plans for 24 more in 2026 and a goal to process 68% of U.S. volume through automated facilities by year-end.

- FedEx reports about 24% of eligible daily volume flowing through 355 Network 2.0-optimized facilities and is piloting robotic arms and partnerships (for example with Berkshire Grey and Dexterity) to expand automation.

- The global warehouse automation market is forecast to top $51 billion by 2030, reflecting heavy industry investment and rising executive prioritization of autonomous supply chains.

- UPS announced substantial job reductions and site closures as part of consolidation: more than 75,000 layoffs over the prior year and 93 facility closures in 2025, with additional planned shutdowns in 2026.

Background

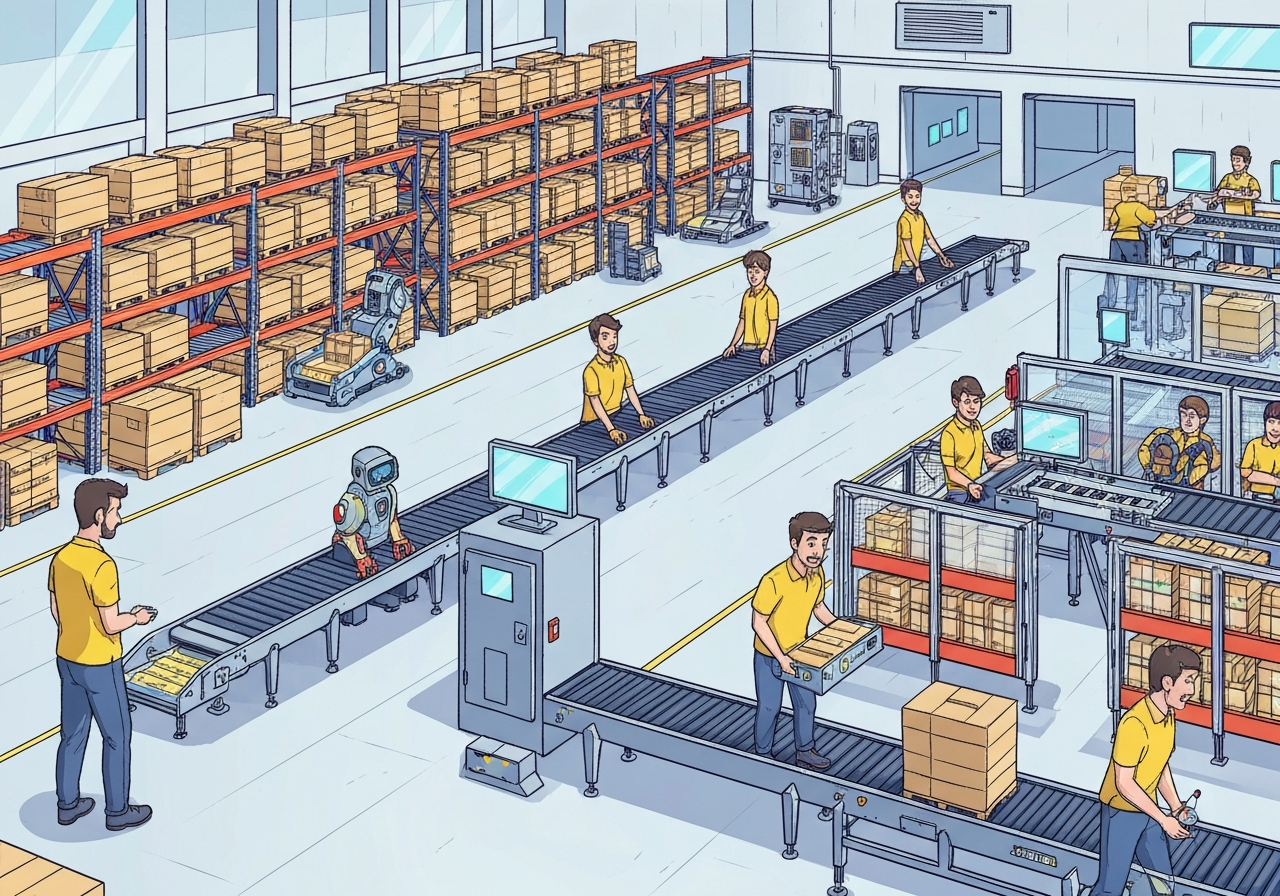

Warehousing and parcel fulfillment have historically been labor- and space-intensive. The rise of e-commerce, peak-season spikes such as Black Friday and Christmas, and pandemic-era disruptions intensified pressure on throughput, labor availability and real-estate choices. Companies facing tight labor markets and high real-estate costs have increasingly explored automation to maintain capacity without proportionally increasing workforce headcount or square footage.

Investment in warehouse robotics and AI accelerated after 2020 as vendors matured product offerings — from collaborative arms and item-picking bots to autonomous forklifts and container-unloading systems. Logistics firms view automation as a lever to compress cycle times, reduce repetitive strain on workers and consolidate older, labor-heavy facilities into fewer, higher-throughput nodes. At the same time, unions and regulators are watching how technology changes jobs, bargaining power and local employment patterns.

Main Event

DHL has rapidly expanded automation across its network. Tim Tetzlaff, DHL’s global head of digital transformation, told CNBC the company scaled from roughly 240 projects in 2020 to about 10,000 by 2026, deploying collaborative robots, automated forklifts and container-unloading machines. DHL says those systems accelerated processes at about 95% of its global warehouses and enabled single-site gains such as a 30% rise in units picked per hour for item-picking robots.

UPS is also moving aggressively. CEO Carol Tomé reported automation deployed in 57 buildings during the fourth quarter, lifting the company to 127 automated buildings with plans for 24 more in 2026. UPS projects that a larger share of U.S. parcel volume will be processed through automated facilities, reflecting both capital investment and a strategy to consolidate older, labor-intensive sites into more efficient nodes.

FedEx describes its Network 2.0 program as central to efficiency gains. The company has tested robotic arms for small-package processing at its Memphis hub and partnered with robotics firms such as Dexterity and Berkshire Grey for unloading and container optimization. FedEx leadership says Network 2.0 has produced structural cost reductions, and currently a significant share of eligible volume is routed through optimized facilities.

The industry narrative emphasizes that robots are handling repetitive, high-throughput tasks — unloading, sorting and repetitive picking — while companies retool hiring toward technical maintenance, automation supervision and process optimization. Executives stress that the goal is augmentation rather than wholesale replacement of labor, though consolidation and site closures have tangible workforce impacts.

Analysis & Implications

Productivity gains from automation are measurable and concentrated in throughput and consistency. Reported site-level improvements — a 30% increase in pick rates and 20% forklift efficiency gains at one DHL facility — scale when replicated across hundreds of locations, producing notable cost and time savings. Over time those improvements can lower per-package handling costs and improve delivery predictability, a key competitive factor in parcel logistics.

Capital expenditure and implementation timelines matter. Automation requires upfront investment in robots, software integration, facility redesign and workforce retraining. Firms with scale and financial resources can deploy faster and realize network-wide benefits sooner, while mid-size operators may face steeper payback calculations. Market forecasts (the $51 billion-plus projection to 2030) reflect heavy vendor activity and continued capital inflows.

Labor impacts are complex and uneven. Some companies report net hiring alongside automation (DHL said it hired 40,000 people during an interval of large robotics deployment), while others report sizable layoffs and facility closures tied to consolidation (UPS reported large reductions and many closures). The net effect will vary by region, plant type and company strategy: repetitive roles are more exposed, technical and supervisory roles are in higher demand.

Strategic implications extend beyond unit economics. Consolidation into fewer, automated hubs changes last-mile planning, requires upgraded transportation links and can alter regional employment patterns. Regulators and unions will likely press for transition plans, retraining commitments and protections for displaced workers, shaping how rapidly and openly firms can scale automation.

Comparison & Data

| Company | Notable metric | Reported impact |

|---|---|---|

| DHL | Up to 650 cases/hr (container unloading); ~10,000 projects | ~95% of warehouses accelerated; item-picking +30% picks/hr; forklifts +20% efficiency |

| UPS | 127 automated buildings (after 57 added in Q4); plans +24 in 2026 | Target: 68% of U.S. volume via automated facilities by year-end |

| FedEx | 355 Network 2.0-optimized facilities; ~24% eligible daily volume | Ongoing pilots: robotic arms, container automation partnerships |

The table summarizes company-level metrics reported on earnings calls and corporate statements. These figures illustrate scale differences: DHL emphasizes robotic deployments by project count and robots in picking; UPS reports automated-building counts and volume targets; FedEx highlights the share of volume run through its Network 2.0 optimizations. Each metric reflects a different maturity signal in automation strategy.

Reactions & Quotes

Executives emphasize efficiency and augmentation. Below are representative quotations with context.

“That is what we look forward to, and where we’ve been successful in deploying technology at scale over the last five years…”

Tim Tetzlaff, DHL (global head of digital transformation)

Context: Tetzlaff framed DHL’s multi-year scaling of robotics as a deliberate program to increase throughput and network flexibility while balancing human work.

“This year, we plan to further automate our network…”

Carol Tomé, UPS (CEO)

Context: Tomé’s remark on the earnings call signaled UPS’s intent to raise the share of U.S. volume processed in automated sites and to continue facility-level consolidation.

“It must support workers, and it cannot work against them ever.”

Lena Melentijevic, Teamsters (spokesperson)

Context: The union emphasized worker protections and a seat at the table as companies expand automation, urging oversight of how technology affects jobs and conditions.

Unconfirmed

- Long-term net job counts across the sector remain uncertain; companies report both hiring and layoffs, and no independent, consolidated national job tally for 2026-era automation impacts has been published.

- Third-party claims about exact payback periods for specific automation projects vary by vendor and site; site-level ROI timelines cited by firms are not independently verified.

- Projections for the $51 billion market by 2030 aggregate vendor and investment forecasts; actual market size will depend on adoption velocity, regulation and macroeconomic conditions.

Bottom Line

Automation is reshaping fulfillment: firms are deploying robots and AI to speed handling, reduce repetitive labor and consolidate networks. The technology delivers measurable site-level gains today and, when scaled, can materially lower per-unit handling costs and increase capacity during peaks.

However, the transition is not uniform. Some companies report net hiring concurrent with automation, while others are closing legacy sites and reducing headcount as they consolidate. Policymakers, unions and firms will need clear transition strategies — retraining, redeployment and social protections — to manage uneven regional impacts.

For readers tracking supply chains, the near-term focus should be on where automation is concentrated (sorting, unloading, item picking), which companies are scaling fastest, and how labor strategies evolve. Over the next five years, expect continued capital investment, more standardized automation deployments and growing demand for technical skills in warehouse operations.

Sources

- CNBC — news report and interviews (media)

- DHL — company statements and press material (corporate)

- UPS Investor Relations — earnings calls and disclosures (corporate/official)

- FedEx Investor Relations — Network 2.0 disclosures (corporate/official)

- Accenture — industry analysis and surveys (consultancy/analysis)