Lead: On Monday, Sept. 8, 2025, the French parliament voted to remove Prime Minister François Bayrou after a confidence motion tied to a contested €44 billion austerity package. Lawmakers opposed Bayrou by 364 to 194, surpassing the 280 votes needed to force his resignation and leaving France without an executive amid rising borrowing costs and geopolitical tensions. President Emmanuel Macron said a new prime minister will be appointed in the coming days, but political deadlock limits his options. The defeat comes nine months into Bayrou’s premiership and follows a string of unstable governments since last year’s snap election.

Key takeaways

- Vote result: 364 MPs voted against Bayrou while 194 voted in favor; the threshold to topple the government was 280 votes.

- Cost-cutting plan: Bayrou linked the vote to a €44 billion savings package (about $51 billion) that proposed freezing spending and cancelling two public holidays.

- Tenure: Bayrou will resign after nine months as prime minister; his predecessor Michel Barnier was also removed by a no-confidence vote in December 2024.

- Economic impact: French bond yields rose above those of Spain, Portugal and Greece after the vote, signaling market anxiety about sovereign risk.

- Political fragmentation: Macron’s 2024 snap election left a splintered parliament, empowering the far right and far left and complicating coalition options.

- Public response: The far left announced nationwide protests and unions plan a mobilization on Sept. 18, increasing the likelihood of street disruptions.

- Potential successors: Armed Forces Minister Sébastien Lecornu and Justice Minister Gérald Darmanin are named among likely but controversial candidates.

Background

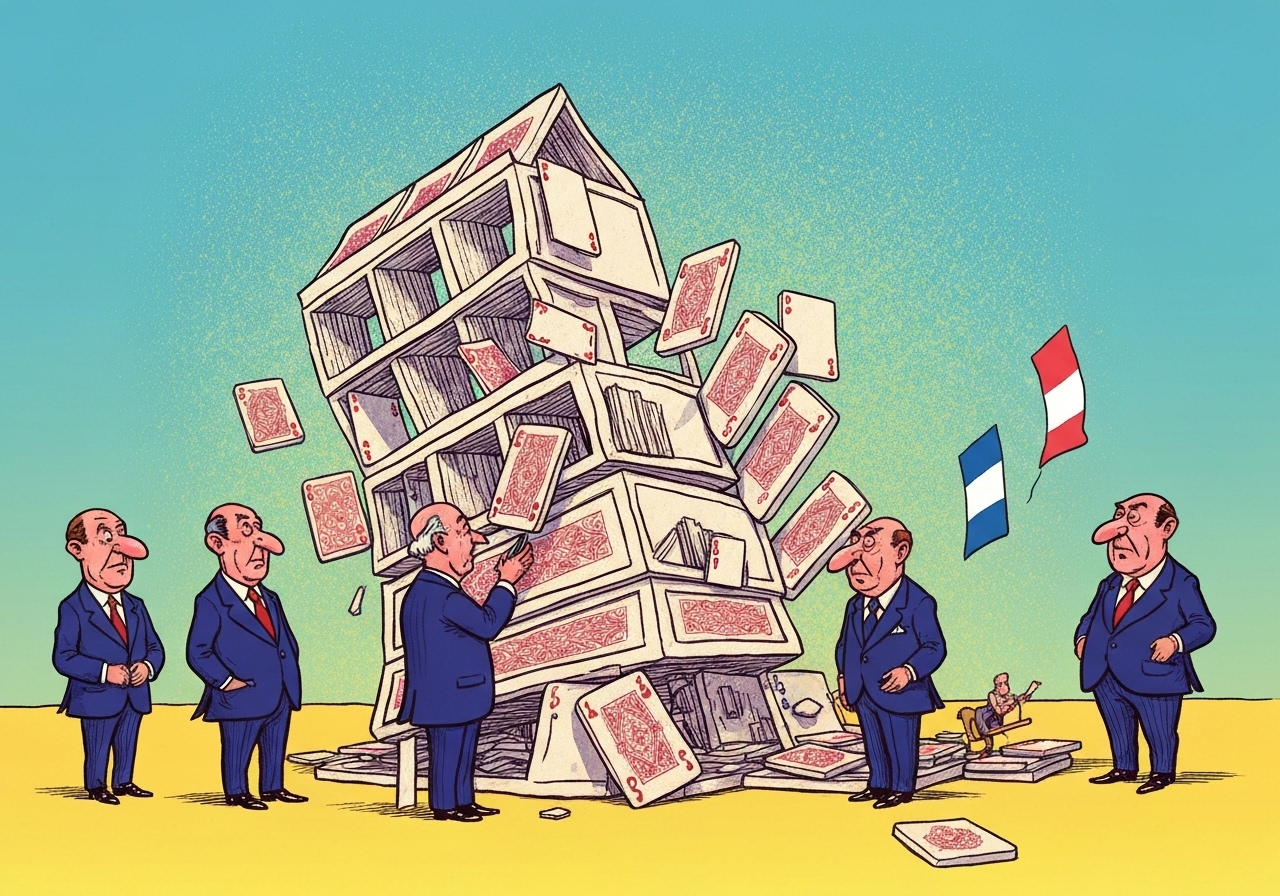

President Macron called a snap parliamentary election in 2024 after strong far-right gains in the May 2024 European Parliament vote. That decision fragmented the National Assembly: Macron’s centrist bloc lost seats while the far right and far left strengthened their positions. The result left no clear majority, forcing fragile coalitions and several short-lived prime ministers to try to govern in a polarized assembly.

Bayrou, a centrist figure appointed nine months ago, framed a €44 billion fiscal consolidation as necessary to rein in mounting deficits and higher borrowing costs. His package — which included measures unpopular with unions and parts of the political center — intensified opposition from both left and right. The confidence vote was his attempt to force passage; instead it accelerated his removal and underscored the limits of executive leverage in a divided legislature.

Main event

On Sept. 8, MPs debated and then voted on a confidence motion Bayrou had tied to the budget-saving plan. The vote recorded 364 MPs against him and 194 in favor, comfortably exceeding the 280 votes required to bring down the government. Immediately after the tally, the Élysée indicated Bayrou would submit his resignation to President Macron the following morning.

Bayrou used his final address to warn of the fiscal reality France faces, saying expenses and debt would not disappear even if his cabinet fell. He also acknowledged generational grievances, stating that the social contract with younger citizens had been strained by the government’s choices. Opponents stressed that the measures were politically tone-deaf and socially regressive.

The Elysee Palace said Macron will name a new prime minister within days, but options are constrained: appointing a centrist successor risks another immediate no-confidence motion from the parliamentary extremes, while naming a leader from the right or left would be blocked by the opposite bloc. Senior ministers including Sébastien Lecornu and Gérald Darmanin are discussed in political circles as potential, though divisive, successors.

Analysis & implications

Economically, the timing is precarious. Rising French bond yields relative to peers increase the cost of servicing debt and narrow policy space for growth measures, just as global markets watch for a possible sovereign-rating review later in the week. A downgrade would ratchet up financing costs and complicate budget negotiations for any incoming prime minister.

Politically, the collapse deepens the post-2024 instability that began with Macron’s snap election. Repeated government turnovers erode confidence in centrist governance and amplify anti-establishment narratives. Polling referenced by analysts suggests the National Rally remains the primary beneficiary in many voters’ minds, posing a longer-term challenge to France’s traditional parties and to Macron’s agenda through 2027.

For governance, the immediate implication is policy paralysis on fiscal reform. Key stakeholders — unions, conservative Les Républicains, and Socialist lawmakers — hold conflicting red lines: tax increases on the wealthy favored by the left, and protection of prior business tax cuts demanded by the right. Without a functional majority, substantive compromise on the €44 billion package is unlikely in the short term.

Comparison & data

| Metric | Position (post-vote) |

|---|---|

| 10-year government bond yields | France > Spain, Portugal, Greece |

| No-confidence margin | 364 against vs 194 for (threshold 280) |

| Fiscal adjustment | €44 billion savings package proposed |

The table summarizes relative market and parliamentary indicators rather than exact intraday yield figures, reflecting the verified fact that French yields have moved above several southern European peers. Those yield shifts reflect investor concern about political instability, not only France’s fiscal math; markets typically penalize countries where policy uncertainty grows and governance appears weak.

Reactions & quotes

Government and opposition voices responded quickly. Officials emphasized orderly transition and the need to protect France’s fiscal credibility; critics argued the government ignored social consensus. Public street reactions ranged from celebration in some towns to calls for mass protest elsewhere.

“You have the power to bring down the government, but you do not have the power to erase reality,”

François Bayrou, outgoing Prime Minister

Bayrou used this line shortly before the vote to warn lawmakers that fiscal pressures would persist even if his cabinet fell. He framed the austerity package as a reluctant necessity rather than a political choice and warned of growing debt costs.

“Dissolve the assembly now,”

Marine Le Pen, National Rally leader

Le Pen urged Macron to call fresh elections, arguing that the current Assembly lacks legitimacy. Political strategists note, however, that another snap election would likely strengthen her party and further fragment national politics.

“Markets are treating political fragmentation as a material risk to France’s credit profile,”

Market analyst (institutional commentary)

Analysts linked the rise in yields to perceived risk of delayed reforms and potential rating actions. They emphasized that sustained political uncertainty is the primary channel through which investor confidence can deteriorate, irrespective of any single budgetary proposal.

Unconfirmed

- Whether President Macron will call another snap election immediately remains unconfirmed; the Élysée has only committed to naming a new prime minister within days.

- The exact timing and outcome of the sovereign rating review referenced by rating agencies is pending and was not finalized at the time of the vote.

- The final composition of any interim or incoming cabinet and whether Lecornu or Darmanin will be formally proposed are unconfirmed and subject to presidential decision-making.

Bottom line

The defeat of Prime Minister François Bayrou removes a government that attempted to impose a large fiscal consolidation in the face of rising debt service costs, but it does not resolve the underlying fiscal or political dilemmas. Markets have responded to the heightened uncertainty, and the risk of higher borrowing costs and a ratings downgrade has risen in the near term.

Politically, repeated collapses underscore the limits of centrist governance in a fragmented Assembly and increase the probability that the National Rally or other anti-establishment forces will gain more influence before 2027. For Macron, the immediate task is to name a successor who can at least stabilize markets while navigating competing party red lines; achieving that balance will be difficult.