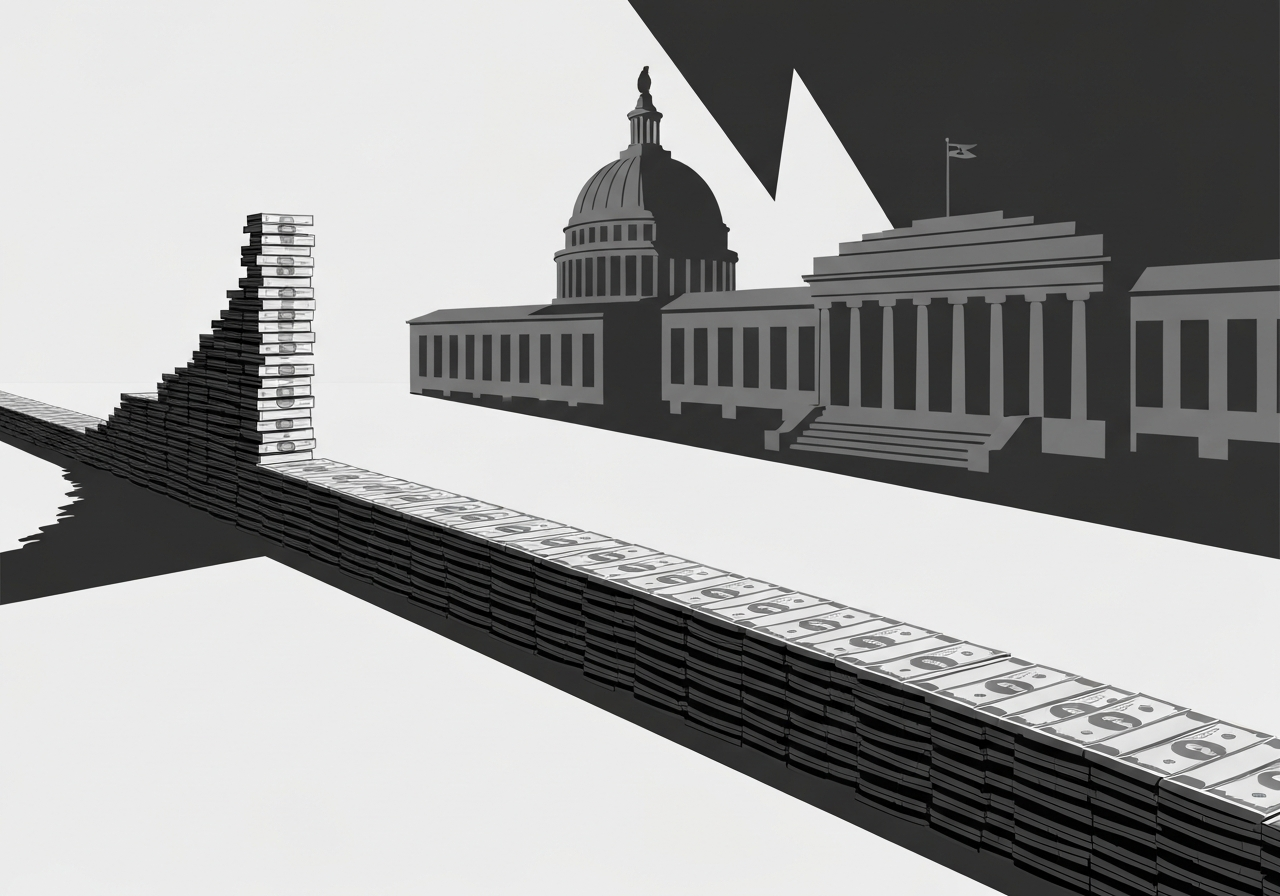

— The nonpartisan Congressional Budget Office released a long-term federal budget forecast showing the United States is on track for historically large borrowing in the decade ahead. The CBO projects a $23.1 trillion deficit over the next nine years under current law, a $1.4 trillion increase from its January 2025 projection made before President Trump began his second term. The report warns that debt held by the public would rise to about 120 percent of GDP by 2036, surpassing post World War II levels and raising concerns about fiscal stability.

Key Takeaways

- The CBO forecasts a $23.1 trillion shortfall for 2026 through 2034 under current law, up from a $21.8 trillion projection made in January 2025.

- Projected public debt will reach roughly 120 percent of gross domestic product in 2036, higher than the post World War II peak on paper.

- Recent federal income tax cuts enacted last year are estimated to cost about 4.7 trillion dollars across the nine-year window.

- Tariff increases implemented by the administration are expected to generate about 3.0 trillion dollars in receipts over the same period.

- Policy changes in the first year of the second Trump term — including tax cuts, higher tariffs, spending adjustments, immigration curbs, and pressure on the Federal Reserve — roughly offset each other on paper, producing only a modest net deterioration in the short-term projection.

- CBO highlights that long-term fiscal pressures leave less room for responding to economic shocks and may raise interest costs and uncertainty for markets over time.

Background

The Congressional Budget Office, established as a nonpartisan analytical arm of Congress, produces regular long-term budget outlooks to show the fiscal implications of current law and known policies. These reports are intended to be descriptive, not prescriptive, and they isolate the budgetary consequences of laws already enacted or scheduled. Over recent decades, the United States has seen rising entitlement outlays and slower revenue growth relative to spending, trends that underpin much of the CBO’s concern.

Debt measured as a share of the economy fell after World War II as rapid growth outpaced borrowing, but demographic shifts and rising health and retirement costs have reversed that postwar trajectory. The CBO compares todays path to earlier high-debt periods to illustrate the scale of change and the limited precedent for managing sustained debt above the size of the economy in peacetime.

Main Event

On Feb. 11, 2026, the CBO published its long-term budget outlook, updating projections it made in January 2025 before the start of President Trump’s second term. The new baseline shows a nine-year net deterioration of 1.4 trillion dollars relative to the earlier outlook. That change reflects enacted tax legislation that reduces long-run revenues and higher tariff receipts that offset some of the cost but do not close the gap.

The report quantifies the effects of specific policy moves. The broad income tax cuts enacted last year are the largest single fiscal hit, near 4.7 trillion dollars across the nine-year window. By contrast, the administration’s tariff package is expected to increase receipts by about 3.0 trillion dollars in the same period, leaving a substantial net revenue shortfall when combined with other tax and spending changes.

CBO also notes that policy actions not fully specified in law, future administrative choices, or economic shocks could change the outlook. Officials emphasized that the projection is conditional on current law and that deviations from those assumptions — for example, further tax legislation or major changes in spending commitments — would alter the path of debt and deficits.

Analysis & Implications

A debt-to-GDP ratio near 120 percent has several practical implications. First, it narrows fiscal policy options during recessions because higher baseline borrowing limits room for additional deficit-financed stimulus. Second, persistent deficits raise the stock of outstanding Treasury securities, which can increase interest costs and crowd out other government priorities as servicing the debt absorbs a growing share of the budget.

Higher public debt can also affect private markets and global perceptions of U.S. fiscal strength. Creditors and investors monitor sustainable fiscal paths, and a sustained rise in debt relative to GDP could translate into higher risk premia or reduced appetite for long-term financing over time. That in turn could feed back into borrowing costs for the federal government and households.

Policymakers face trade-offs. Closing a portion of the projected shortfall could require spending restraint, tax increases, or both, each with different economic and political consequences. The administration and Congress will need to weigh near-term growth priorities against longer-term sustainability as they consider budgeting choices in the coming months and years.

Comparison & Data

| Measure | January 2025 Projection | February 2026 Projection | Net Change |

|---|---|---|---|

| Nine-year shortfall (2026-2034) | $21.8 trillion | $23.1 trillion | $1.4 trillion |

| Debt held by the public as share of GDP (2036) | Below 120 percent (prior forecast) | About 120 percent | Increase to historic highs |

| Tax cut cost (nine years) | N/A | $4.7 trillion | — |

| Tariff receipts (nine years) | — | $3.0 trillion | — |

The table summarizes headline figures highlighted by the CBO. The nine-year shortfall is the clearest numeric indicator of near-term fiscal imbalance, while the debt-to-GDP ratio offers a snapshot of longer-term magnitude. Individual line items such as projected tariff revenue and the cost of enacted tax changes help explain how specific policies contribute to the overall picture.

Reactions & Quotes

The CBO framed the numbers as a reflection of current law and demographic trends rather than a political judgment.

Debt held by the public is projected to grow to levels that exceed the size of the economy, presenting risks to fiscal flexibility.

Congressional Budget Office (nonpartisan report)

The White House defended its policy mix as supportive of growth while acknowledging hard choices remain.

The administration says recent measures are intended to strengthen long-term growth while addressing budgetary pressures.

White House statement (administration)

Independent analysts emphasized tradeoffs between growth and sustainability.

Economists note that higher deficits can constrain policy options and raise interest costs if left unchecked.

Independent economists and policy analysts

Unconfirmed

- Future macroeconomic impacts of the tariff program remain uncertain and depend on behavioral responses from consumers, businesses, and trading partners.

- The extent to which future legislation or administrative action will alter the CBO baseline is unknown and not reflected in the current projections.

- Precise market reactions and the timing of any increase in borrowing costs are uncertain and contingent on investor sentiment and global conditions.

Bottom Line

The CBO report signals that current policy and demographic trends point toward historically high public debt over the next decade and beyond. While the administration’s actions in its first year of a second term produced offsetting fiscal effects on paper, the overall trajectory still produces a larger projected shortfall than a year earlier.

Policymakers and markets should watch upcoming budget legislation, entitlement spending trends, and interest cost trajectories closely, because those factors will determine whether the projection becomes reality or is altered by new policy choices. The coming months will be decisive for setting a credible path toward longer-term fiscal stability.

Sources

- The New York Times (news)

- Congressional Budget Office (official nonpartisan agency)

- U.S. Department of the Treasury (official)