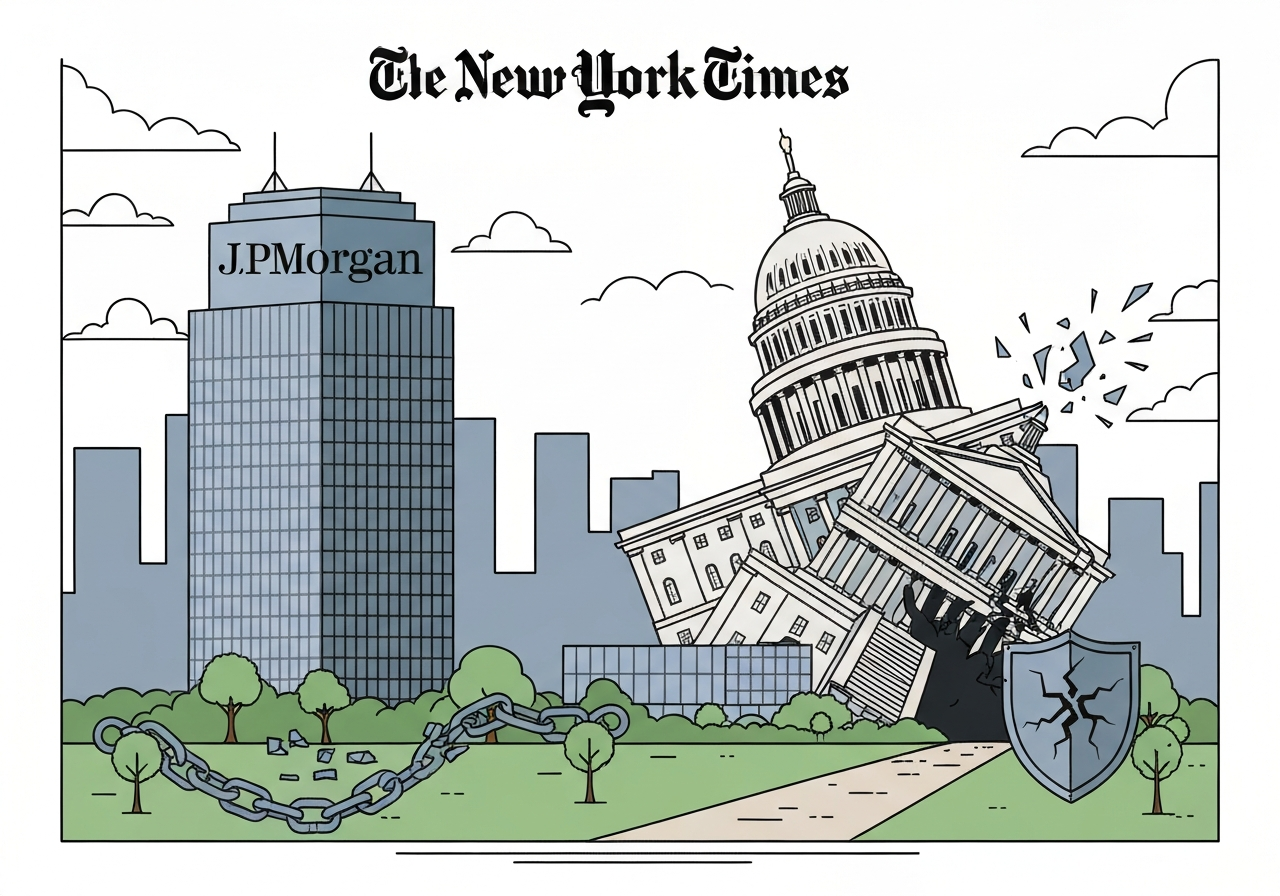

JPMorgan Chase told a court in February 2026 that it closed more than 50 bank accounts tied to former President Donald J. Trump and the Trump Organization in February 2021, shortly after the Jan. 6, 2021, attack on the U.S. Capitol. The disclosure came in the bank’s formal response to a lawsuit filed by Mr. Trump and the Trump Organization in January 2026, which accuses the bank of politically motivated “debanking.” The accounts included commercial and personal relationships spanning hotels, real estate projects and retail operations in Illinois, Florida and New York. JPMorgan has not publicly given a detailed rationale in the filings for the mass closures.

Key Takeaways

- JPMorgan told the court it closed more than 50 Trump-related accounts in February 2021, weeks after Mr. Trump left office.

- The accounts cited in court filings covered Trump hotels, housing developments and retail shops in Illinois, Florida and New York, plus a private personal banking relationship tied to Mr. Trump’s inheritance.

- Mr. Trump and the Trump Organization filed suit in January 2026, naming JPMorgan CEO Jamie Dimon among the defendants and alleging political discrimination.

- JPMorgan has described its lawsuit as without merit but has previously said it closes accounts that create legal or regulatory risk for the company.

- In an unsigned Feb. 19, 2021 note to Mr. Trump, the bank advised he should “find a more suitable institution with which to conduct business,” a message later filed in court.

- The bank has asked to move the case from Florida state court to federal court in New York, signaling a protracted legal battle ahead.

Background

The question of whether major banks curtailed relationships with Mr. Trump after Jan. 6 has been contested for years. Mr. Trump has repeatedly characterized account closures and banking refusals as politically driven “debanking,” citing actions he says were taken by multiple lenders after the Capitol attack.

Banks privately and publicly balance commercial relationships against legal, regulatory and reputational risk; since Jan. 6, financial institutions have said they review clients for potential exposures. Regulators have also adjusted enforcement priorities, and bank executives have argued for clearer guidance on how to weigh reputational factors without becoming arbiters of politics.

Previous public disputes included Mr. Trump’s claims about Capital One and Bank of America. Those companies’ actions have been described by Mr. Trump and his allies as part of a broader pattern; however, until JPMorgan’s recent court filing, large lenders largely avoided acknowledging specific account-level decisions tied to Mr. Trump.

Main Event

The current litigation began when Mr. Trump and the Trump Organization filed a complaint in January 2026 in Florida state court, alleging the bank severed ties to punish his political views. In its formal response submitted in mid-February 2026, JPMorgan stated it closed over 50 accounts associated with Mr. Trump in February 2021, a disclosure that confirms the core factual claim at issue in the suit.

Court documents list the affected accounts as those serving Trump hotels, residential developments and retail locations in Illinois, Florida and New York, and reference a private-banking relationship that managed funds Mr. Trump inherited from his father. The bank’s filings do not provide a single explanatory rationale tied to political views; instead the filings reiterate that account closures may stem from legal or regulatory risk assessments.

An unsigned bank note dated Feb. 19, 2021 and included in the court record advised Mr. Trump to “find a more suitable institution with which to conduct business.” The note closed with a conventional sign-off; the filing shows the communication was not personalized by name in the signature block.

JPMorgan has sought to transfer the case from Florida state court to federal court in New York, underscoring expected jurisdictional and procedural fights. Both sides signaled readiness for extended litigation: Mr. Trump’s team framed the suit as standing up to widespread “debanking,” while the bank has flagged legal and regulatory concerns as the general basis for account decisions.

Analysis & Implications

JPMorgan’s admission in court is significant because it converts Mr. Trump’s long-standing allegation into an acknowledged fact: the bank did, in fact, close those accounts in February 2021. That narrow factual confirmation does not, however, determine motive. The bank’s filings stop short of linking the closures explicitly to political views, leaving the central legal question—whether the actions violated law or were discriminatory—open for adjudication.

For banks, the case highlights the operational and compliance complexity of managing high-profile clients. Financial institutions must weigh potential regulatory exposure, anti-money-laundering obligations and reputational considerations. A judicial finding that closures were lawful on risk grounds would reinforce banks’ discretion; a contrary ruling could prompt stricter standards or new legislative attention to so-called “debanking.”

The dispute also fuels political debate. Mr. Trump has used personal banking claims to argue for broader limits on how financial firms assess clients’ political profiles. If courts find banks acted improperly, that could spur legislative proposals; if courts defer to banks, regulators may nonetheless refine guidance to reduce the appearance of politics-driven decisions.

Internationally, the case may draw attention from foreign banks and regulators watching how domestic courts balance corporate risk-management and civil liberties. U.S. precedent could influence cross-border practices on handling politically exposed persons and reputational risk, especially where public figures face criminal or civil scrutiny.

Comparison & Data

| Bank | Admission / Action | Timing | Verification |

|---|---|---|---|

| JPMorgan Chase | Closed >50 Trump-related accounts | February 2021 | Admitted in court filing (Feb. 2026) |

| Capital One | Alleged account closures reported by Mr. Trump | After Jan. 6, 2021 | Reported as allegation (unconfirmed) |

| Bank of America | Alleged refusal to accept deposits | After Jan. 6, 2021 | Reported as allegation (unconfirmed) |

The table distinguishes a court-confirmed admission by JPMorgan from other claims that remain unverified in public records. This distinction matters legally: an allegation can prompt investigation, but a documented admission becomes central evidence in litigation and public debate.

Reactions & Quotes

JPMorgan has long taken a cautious public posture on client closures; in filings and statements the bank has framed account terminations as responses to legal and regulatory risks. The remark below represents that stance as previously provided to reporters and to the court record.

“As a rule, JPMorgan closed accounts because they create legal or regulatory risk for the company.”

JPMorgan spokeswoman (company statement reported to The New York Times)

Mr. Trump’s legal team framed the suit as part of a broader fight against what they describe as politically motivated exclusion from financial services.

“President Trump is standing up for all those wrongly debanked by JP Morgan Chase and their cohorts, and will see this case to a just and proper conclusion.”

Trump legal team (plaintiff statement)

The unsigned bank communication filed in court provides the contemporaneous operational message delivered to Mr. Trump in February 2021.

“You will need to find a more suitable institution with which to conduct business.”

Unsigned JPMorgan note, Feb. 19, 2021 (filed in court)

Unconfirmed

- Whether JPMorgan closed accounts specifically because of Mr. Trump’s political views remains unproven in the public record beyond the timing and the bank’s admission of closures.

- Capital One’s and Bank of America’s alleged actions after Jan. 6 are reported as claims by Mr. Trump and have not been confirmed in equivalent court filings.

- Any internal JPMorgan documents explicitly tying the closures to a corporate political policy have not been publicly disclosed as of the Feb. 21, 2026 reporting date.

Bottom Line

JPMorgan’s court filing confirming the closure of more than 50 Trump-related accounts in February 2021 turns a long-standing allegation into an established factual point, but it does not by itself resolve the lawsuit’s core legal question about motive or illegality. The bank’s invocation of legal and regulatory risk as a general justification leaves room for argument on both sides and ensures the case will hinge on internal records, witness testimony and statutory interpretation.

Readers should expect prolonged litigation and appeals: jurisdictional disputes, evidentiary fights over internal communications, and potential regulatory scrutiny could all follow. Beyond the courtroom, the outcome could influence how banks set policies for politically connected clients and how lawmakers consider protections against politically motivated denial of financial services.

Sources

- The New York Times (news reporting)

- JPMorgan Chase (official corporate site)